May 10, 2017

Double Trouble: Tips for Handling Divorce and College Expenses

Children and Divorce, Finances, Future Post-Divorce

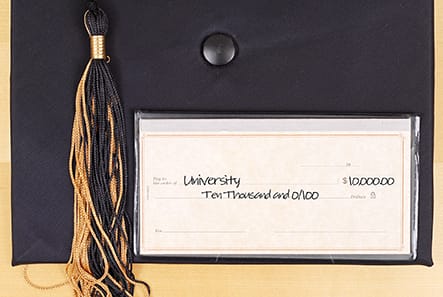

The familiar saying, “When it rains, it pours” applies to many of the clients in our Alpha Divorce Divorce Mediation Program. Just as they are stretching their dollars to operate two individual households, the first college tuition bill arrives.

We often see this “double trouble” during divorce mediation, so we wanted to be able to give our clients the best guidance on this subject. David Emery, of Marshall Financial and an expert on college financing, was kind enough to share his wisdom with our lawyers and accountants. He also took the time to answer some general questions about affording college in the aftermath of a divorce.

- Our divorce mediation clients usually struggle with the added expense of divided households. Those with college age children have the added stress of trying to pay for college. Do you have any tips for them?

—I think it makes sense to have an understanding of who will help pay for college and how much (ie: set a budget limit). Parents are not obligated to pay for their children’s education. Setting the expectation about to handle this expense can go a long way to reducing family stress.

- What type of college savings plans do you recommend for clients who can contribute to college funds after their divorce?

—There really isn’t one answer for this question. Some of the areas to consider include: Will the family qualify for need-based financial aid? Who will the child spend majority custody with approaching and during college years? Who will be involved in paying for college? How many years do you have until college? Answers to all of these questions can help to decide what is the best type of financial entity (or entities) to save for college.

- If our divorcing clients have to choose between contributing to their retirement fund or college for their children, which do you recommend?

—We typically recommend saving for retirement first and then college second. There are many reasons for this, but one of the biggest is that retirement is not something that you can borrow money for, college you can.

During our discussion, Dave outlined how important “timing” was for college planning purposes. One date that he considers most important is December 31st of the child’s high school junior year. The taxes filed for the year before a child finishes this year are pivotal in determining financing.

Dave has many tools available to identify the schools who offer the best financial aid package. Another lesson he taught us is that first financial aid package offered is not always the best, so consider negotiating to get a better offer.

As my teenage daughters prepare for college, you can be sure that my first call will be to Dave to find out how to get them the best education with the lowest financial burden. I recommend that everyone with teenagers or college students do the same.

Finally, please keep in mind Dave’s recommendation to secure your retirement before obligating yourself to pay college expenses. I recently worked with a couple in our King of Prussia, Montgomery, PA office who are both very close to retirement. They have two college kids who have accumulated over $200,000 in college loans. Against my advice, they cashed in their retirement accounts to pay off these loans. I am very concerned that one day they will be penniless on their children’s doorstep asking for help. I certainly hope they get it because they left themselves with no other options. These are the kinds of situations that keep us divorce mediators up at night…….