The saying goes that the only things certain in life are death and taxes. But when couples divorce, there are likely to be tax ramifications that can be a financial “kiss of death” if ignored. Most divorce attorneys who assist Clients do not adequately explore and analyze their tax picture.

At Alpha Center for Divorce Mediation, we provide advice on filing taxes after divorce and make sure to carefully identify any tax issues, so that our couples have a true picture of their financial situation after the divorce dust has settled. The professionals at Alpha Center know that good tax planning puts additional cash in the pockets of Clients when they need it most. We also know how important it is to look at the tax consequences of dividing and transferring assets from one person to the other to avoid surprises and unfairness.

Alpha Mediation Meeting: Tax Planning

Prior to the meeting, the Accountant-Mediator reviews the Client Financial Terms to identify any unforeseen tax burdens. They also review the last three years of tax returns to uncover any potential audit issues, missed deductions, or tax carryforwards, and determine the impact on the couple’s future taxes. Each party that signs a return is held liable for the information provided and the resulting tax obligations. If there are any obvious issues that may trigger an audit, both parties should be made aware of this. On the positive side, a divorce tax planner may uncover missed deductions, allowing one to amend a previous return that could produce up to thousands of dollars in tax refunds.

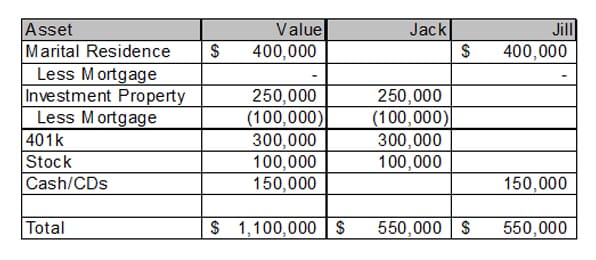

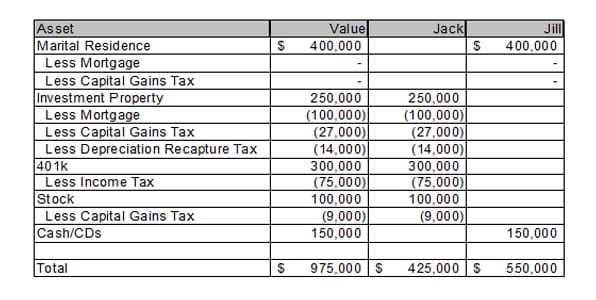

The Accountant-Mediator will also analyze for future tax issues. This covers tax filing status per Internal Revenue Service regulations, rights to the dependency deductions, related tax credits associated with the dependents, proper methods for dividing assets to minimize tax liabilities, and the impact of alimony and child support on taxes.

During your tax mediation meeting, the Accountant-Mediator reviews his findings and discusses the best strategies so that both clients have a clear understanding of the best path forward. We are conscious of the fact that in many couples, one spouse may be more familiar than the other with finances and taxes in their household. Part of being neutral means the Accountant-Mediator will make sure each spouse leaves with a sound understanding of the tax picture. Based on the findings and discussions, divorcing couples will run various scenarios and tax projections with the Accountant-Mediator to determine which one will result in the lowest taxes and the highest cash flow.

The Accountant-Mediator then prepares the tax terms which are included in the Marital Settlement Agreement.

The attorney-mediators at Alpha Center know how confusing the divorce process can be. That’s why we’re here to help answer all questions you might have about how filing taxes after divorce works. If you live in the Philadelphia, Bucks or Montgomery County, PA areas, turn to the divorce mediators at Alpha for assistance.